A Steep Sin Tax?

By Chuck Sudo in Food on Oct 26, 2007 6:09PM

Gone largely unnoticed among the other notable tax increases proposed by His Elective Majesty to plug the gaping hole in his 2K8 budget is the whopping $13.1 million increase to the liquor tax. The proposed increase will add 8¢ to a six-pack of beer, 7¢ to a bottle of wine, and 24¢ to a liter of hard liquor.

Gone largely unnoticed among the other notable tax increases proposed by His Elective Majesty to plug the gaping hole in his 2K8 budget is the whopping $13.1 million increase to the liquor tax. The proposed increase will add 8¢ to a six-pack of beer, 7¢ to a bottle of wine, and 24¢ to a liter of hard liquor.

Fittingly, this isn't sitting well with the beer wholesaler lobby. The Associated Beer Distributors of Illinois are calling for help in opposing an 87.5 percent increase in the beer excise tax. From their web alert:

Currently the highest costing ingredient in beer is taxes! The Chicago beer excise tax is 16 cents per gallon. The proposed increase would hike the tax to 30 cents per gallon, making Chicago beer one of the most heavily taxed beverages in the nation. If Mayor Daley's proposed beer tax were to pass, each case of beer would increase for (sic) 91 cents to $1.22 per case. The total tax on a barrel of beer would be $16.90, a full 114 percent higher that the average beer tax.

Given the choice of losing our home to an outrageous property tax increase or having to pay an extra thirty-one cents for a case of beer, the choice is simple. We'll just carry an extra dime or two in our pockets to make sure we can afford to buy beer. Considering ABDI's involvement in getting HB 429 signed into law, it's also simple to say that this is a case of the chickens coming home to roost. It's usually the haves who protest the loudest whenever taxes are increased. Maybe the ABDI can turn their considerable lobbying skills to convincing Mayor Daley to stop diverting our tax dollars to TIFs.

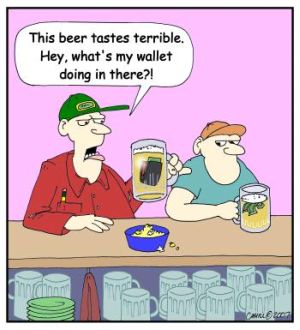

Cartoon via Friends of Americans for Tax Reform.